Markets posted gains sufficient to close breakdown gaps – sufficient to negate these gaps as breakdowns – but leaving indices stuck in broader trading ranges.

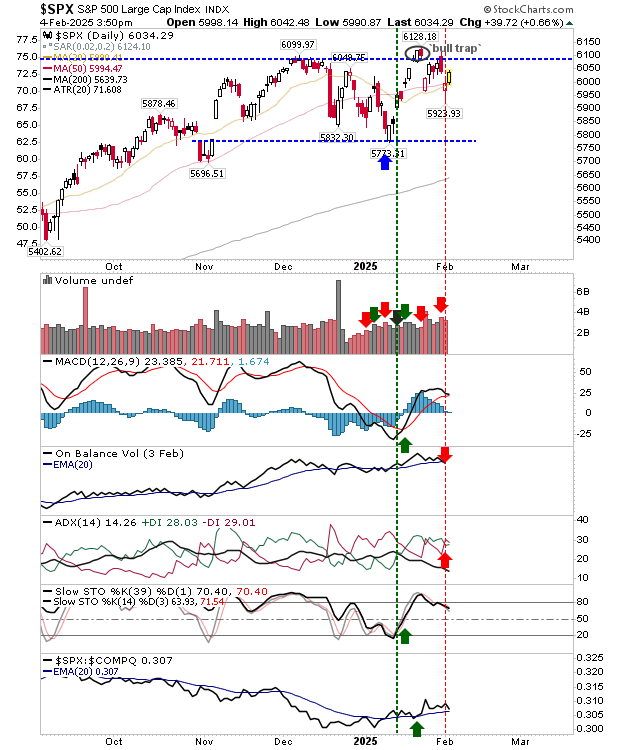

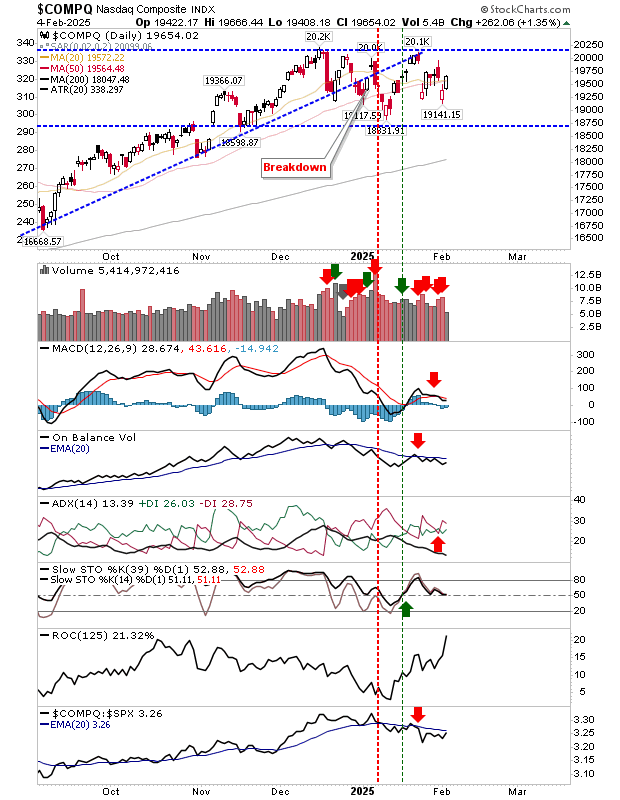

The () is a case in point. yesterday saw a ‘sell’ trigger for On-Balance-Volume, following-on from ‘sell’ triggers in Stochastics and +DI/-DI.

Only the MACD is hanging on, but it’s close to a ‘sell’ trigger from below the bullish zero line. Price action was more bullish, but the 50-day MA remains as resistance.

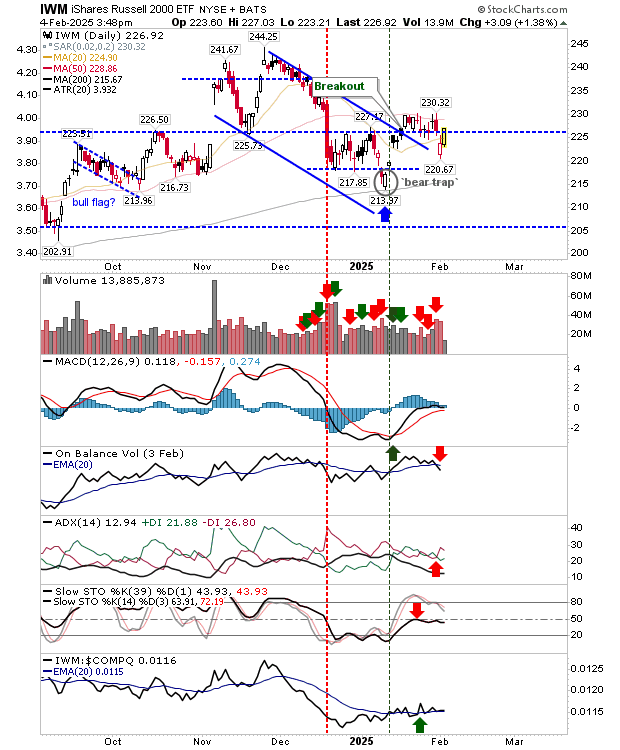

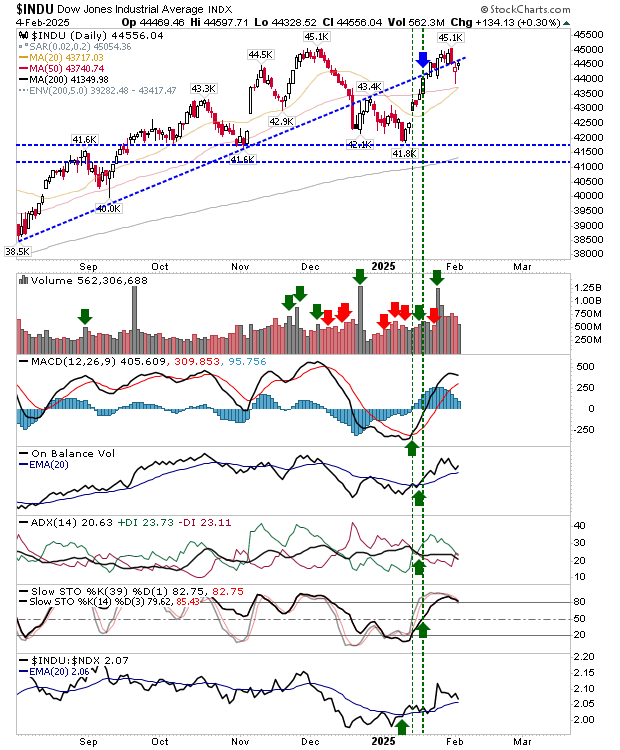

The has a 50:50 mix of bullish and bearish technicals: The MACD and Stochastics are bullish, On-Balance-Volume and +DI/-DI are bearish.

The tie-breaker is bullish relative outperformance of the S&P 500 to the . yesterday’s price action closed Friday’s breakdown gap.

The is the more bearish of the indices. It has ‘sell’ triggers in the MACD, On-Balance-Volume and +DI/-DI with stochastics close to completing the set. Since breaking the trend in December it has been moving in a sideways pattern with 20-day and 50-day MAs converging. As with the Russell 2000 ($IWM) and S&P 500, it has managed to close Friday’s breakdown gap, but the index is likely to struggle from here.

The sits at an interesting juncture. There is a shorting opportunity if you are a bear as the index again tags what was once support, now resistance.

It may be a slow burner though, and take a few days to play out. Going against this is the net bullish play in technicals.

After the two positive days we have seen I suspect today will be one of consolidation. Even with potential bearish setups, I will be looking for narrow-range days (doji or spinning tops). It’s unlikely to be one to easily day-trade.

#Nasdaq #Dow #Jones #Russell #Face #Key #Resistance #Closing #Gaps