Intel on Thursday said that its codenamed Clearwater Forest processor for data centers will only be launched in the first half of 2026, roughly two years after the company introduced its Xeon 6-series CPUs and one or two quarters behind schedule. By contrast, Intel’s Panther Lake product for client PCs — which uses the same 18A process technology — is on track for a 2H 2025 launch.

The delay of the key server processor comes amid the company’s unveiling of Intel’s financial results for the fourth quarter of 2024 and the entire year, which revealed massive losses. Paired with Intel’s announced cancellation of its Falcon Shores AI GPUs, Intel’s competitive posture for the exploding AI market is now severely weakened.

Clearwater Forest delayed

”We are also making good progress on Clearwater Forest, our first Intel 18A server product that we plan to launch in the first half of next year,” said Michelle Johnston Holthaus, interim co-CEO of Intel, during the company’s earnings call on Thursday. Holthaus cited difficulties with Clearwater’s packaging technology but said the underlying 18A process node remains strong.

Currently, Intel is ramping up production of its energy-efficient Xeon 6 ‘Sierra Forest’ and high-performance Xeon 6 ‘Granite Rapids’ processors. It believes that these CPUs will be instrumental in stabilizing its market share this year. However, with the next-generation Xeon 7-series ‘Clearwater Forest’ and Xeon 7 ‘Diamond Rapids,’ Intel probably expects to turn the tables and start regaining market share.

However, there may be a setback to this plan, as Intel originally promised to launch Clearwater Forest in 2025, but it now says that the new CPUs will be released in the first half of 2026. The delay will affect Intel’s competitive position in the data center market and postpone potential design wins with interested parties.

Clearwater Forest holds additional significance for Intel, as this is the first data center CPU with compute chiplets manufactured on the Intel 18A process technology (1.8nm-class) and featuring a Foveros 3D base die fabbed on the Intel 3 production node. If the company can mass-produce Clearwater Forest cost-effectively, it will be a major testament to its 18A manufacturing process—which happens to be the first technology developed both for Intel and its foundry customers—as a success. This could also attract potential clients to Intel Foundry. For now, Intel is optimistic about 18A.

“18A has been an area of good progress,” said David Zinsner, interim co-CEO and chief financial officer of Intel, during the call. “Like any new process, there have been ups and downs along the way, but overall, we are confident that we are delivering a competitive process.”

Intel’s 2024 Revenue Flat, But Losses Climb to $18.8 Billion

The company’s losses stem from major investments in new fabs and production capacity in the U.S. These investments will only pay off if Intel’s execution over the next couple of years is solid and its 18A technology is competitive in terms of performance and cost.

The delay of a key product comes at a particularly bad time for Intel. The company’s revenue for 2024 totaled $53.1 billion, down 2% year-over-year, which may be considered relatively flat. However, the company’s net loss climbed to $18.8 billion compared to a modest $1.7 billion profit the previous year.

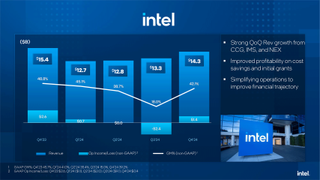

Intel’s fourth-quarter results for 2024 showed that the company earned $14.3 billion in revenue, up $1 billion from the previous quarter but down 7% from the same quarter a year ago. During Q4, the company posted a $100 million loss, whereas in Q4 2023, its profit was $2.7 billion.

Revenue for Intel’s Client Computing Group (CCG) increased to $8 billion while generating an operating income of $3.1 billion, which is down from $8.8 billion in revenue and $3.6 billion in Q4 2023. Intel suspects that a portion of its Q4 revenue increase was due to its clients hedging against potential tariffs.

Intel’s Data Center and AI Group (DCAI) is less vulnerable to tariffs, so its revenue stood at $3.4 billion, up from $3.3 billion in the previous quarter but down from $3.5 billion in the same quarter a year before. However, the group’s profitability hit a new low of $200 million.

Intel’s Networking and Edge Computing (NEX) business revenue increased to $1.6 billion, rising both sequentially and year-over-year. The unit’s profitability also increased to $300 million, marking its best performance in recent quarters.

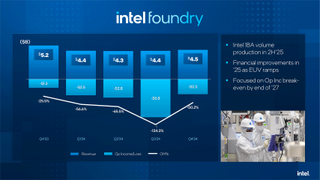

Intel Foundry earned $4.5 billion in revenue and recorded a $2.3 billion loss. On an annual basis, Intel Foundry’s revenue declined from $5.4 billion, while its losses widened to $2.3 billion. However, the company saw quarter-over-quarter improvement, increasing revenue from $4.4 billion and reducing losses from $5.8 billion. Intel attributes this improvement to an increased EUV wafer mix and higher equipment sales by IMS Nanofabrication. For the full year, EUV wafer revenue grew from 1% of total revenue in 2023 to over 5% in 2024.

Altera delivered revenue of $429 million, up 4% sequentially, with an operating margin of 21% compared to 2% in Q3. Mobileye reported revenue of $490 million, up 1% sequentially, with an operating profit of $103 million.

Humble Outlook

Intel expects its revenue to be between $11.7 billion and $12.7 billion for the first quarter of 2025, down $0.5 billion from Q1 2024. Also, Intel expects its GAAP gross margin to fall to 36%.

#Intel #delays #key #Xeon #data #center #processor #massive #losses #Clearwater #Forest #pushed